Picking up the pace

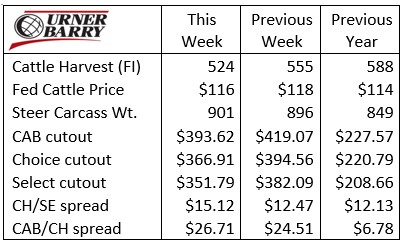

The fed cattle market has remained relatively steady over the past two weeks. Though a six-state fed steer price came in $2/cwt. lower last week while the heavy trade volume however, came in at $118/cwt.

This Monday there was already trade at $118 in some major feeding states yet Tuesday trade was softer at $113/cwt. Early-week trade means packers need cattle, which means processing is moving along.

Confirmed data from the week ending May 15th shows that carcass weights continue to climb. The data is posting steers up 5 lb. at 901 lb. each. This is an amazing 52 lb. gap above a year ago at this time. Heifer carcasses were up 2 lb. to average 831 lb. apiece. The CAB carcass average was down 7 lb. in the following week’s data to 883 lb. but this one-week reversal does not constitute a trend.

Live cattle futures have failed to impress lately with the June contract retreating from last Thursday’s $101.47/cwt. close. This ended a weak, yet promising run to more realistic valuations compared to the cash market.

This Tuesday’s limit down move in the June contract suggests lower beef cutout values may have futures traders on the defensive. Convergence of the live cattle contract and cash prices is well out of reach.

Just as newsworthy is the latest action in wholesale boxed beef pricing. Certainly all prices within the current timeline are outside of expected ranges but we’re seeing the right direction develop across the carcass cutouts as a whole.

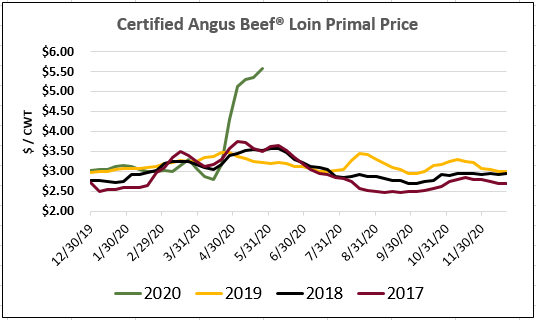

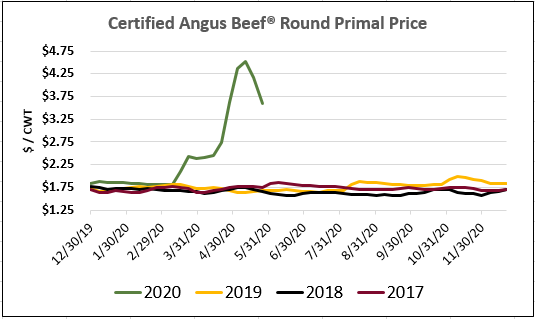

In this case, the “right direction” happens to be lower prices on end meats and thin meats. Justification for this statement lies in the inevitable loss in consumer demand we would expect to see unless end meats shed a significant share of their current prices. The correction is underway across some of the carcass, as every chuck and round subprimal was priced lower in the weekly price summary. This culminated in a needed $50/cwt. decline in those two end meat primals in the past week.

Middle meats continue to climb higher with ribs up $7.00/cwt. and the loin primal up $21/cwt. Seasonality is still a factor and consumers are ready to get some normalcy in their lives with spring grilling which means demand for middle meat steaks. Somewhere near June 1st we typically see a defined seasonal peak in strip loin prices and a less reliable peak for ribeyes. Let’s not bet the farm on historical trends this season.

Picking up the pace

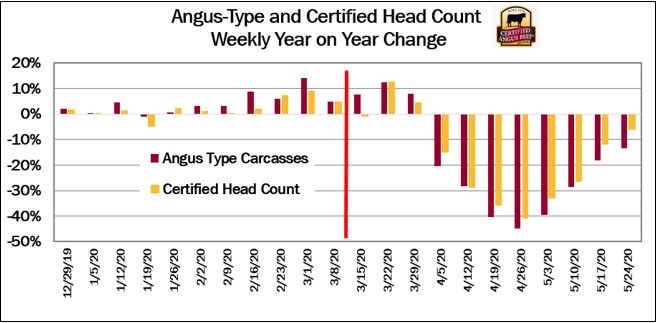

It’s been a matter of just over four weeks since the beef packing industry hit a collective low point for harvest productivity during the pandemic. The last full week in April pegged the Federally Inspected (FI) cattle harvest at 438K head (adjusted up from the initial 425K estimate), 65% of the total that week a year ago.

National headlines featured the human health crisis throughout the animal packing sector and the meat shortage became a real issue, rather than one of perception. Undoubtedly there are lasting impacts and personal stories from the illness that sadly can’t be undone.

However, from a productivity standpoint, regarding the ever-important flow of cattle through the processing sector we’ve seen a rather rapid recovery. Cattle feeders unable to make delivery on their heavy, over finished inventory would likely argue the point. Yet the numbers are impressive in the period since the worst of the slowdown.

For the past two weeks the FI harvested head count has been 86% and 89% of the same two weeks a year ago, respectively. However, we don’t know for sure what the new “maximum” production will be under the new health and safety precautions within the plants. It’s been suggested that the new level is 90% of previous high production levels, but that’s a guess. If the guess turns out to be factual then it has essentially been achieved. One could argue that expanded Saturday harvest schedules are one way to achieve a weekly head count closer to a year ago. This is logical to a degree, but recall that 2019 included a lot of productive Saturdays in packing plants compared to prior years.

The chart, below, depicts the percentage change in current vs. year ago supplies of Angus-type fed cattle (eligible for CAB based on live specs) and carcasses subsequently certified for the brand. Bars to the right of the bright red separator show the weeks subsequent to the country beginning to shut down in mid-March. Bars below “0% change” are resulting packing plant slow-downs and temporary shutdowns due to COVID-19.

CAB licensed end users should get relief soon if the supply trend continues in this direction. Latest USDA data shows Choice (71.7%) and Prime (12.2%) are now at a combined record-high proportion of the steer/heifer carcass mix at 83.8%. The most recent CAB acceptance rate is at 36.6%, more than 2 percentage points higher than a year ago. This yields only a 6% smaller supply of CAB brand carcasses than a year ago.

The road ahead

The beginning of June marks the end of Beef Month. “Good riddance” is a term that comes to mind for many in the business.

One data source points to fresh beef volume gains at retail of 20%, year over year, for the four weeks ending May 24th. Total dollar gains are pegged at 35% but to suggest that retail profits enjoyed the upside is mostly unlikely. Total revenue would have been bolstered, of course, on much higher volume. Small margins are workable at a high volume.

Some retailers may have made beef purchases well ahead of the supply shortage and placed product in a “suspended fresh” storage. This may have benefited a few, but it’s more likely that most end-users had to step into the weekly market to fulfill their newly elevated needs at record prices. This being the case, profits would have been elusive as meat case prices would have had to reflect little profit margin to coerce the customer to buy.

Foodservice business continues to suffer with some simply choosing to trim certain beef items from their menu. We hear some distributors are staying out of the market as best they can, just fulfilling their immediate needs hand-to-mouth.

This points to the economic reality that the conclusion of the beef-centric spring holiday buying will bring on more price adjustments as is the seasonal norm. This year, an increase in product availability will be key, with supply and demand aligning a bit more. Once a buying push is complete ahead of the Independence Day holiday, it is likely cutout values will move decidedly lower into the dog days of summer. The trend is underway for chuck and round items yet values remain elevated. Middle meat demand still outpaces current supply.

DON’T MISS THE LATEST HEADLINES!

Above and beyond nutrition

Optimize grazing plans

New thresholds for Targeting the Brand™

Field trips to the farm

Read More CAB Insider

$100,000 Up for Grabs with 2024 Colvin Scholarships

Certified Angus Beef is offering $100,000 in scholarships for agricultural college students through the 2024 Colvin Scholarship Fund. Aspiring students passionate about agriculture and innovation, who live in the U.S. or Canada, are encouraged to apply before the April 30 deadline. With the Colvin Scholarship Fund honoring Louis M. “Mick” Colvin’s legacy, Certified Angus Beef continues its commitment to cultivating future leaders in the beef industry.

Carcass Quality Set to Climb Seasonally

With the arrival of the new year the beef market will rapidly adjust to changes in consumer buying habits. This will remove demand pressure from ribs and tenderloins, realigning the contribution of these most valuable beef cuts to a smaller percentage of carcass value

Misaligned Cattle Markets and Record-high Carcass Weights

Few things in cattle market trends are entirely predictable but the fact that carcass weights peak in November is as close to a sure bet as one could identify. Genetic selection for growth and advancing mature size has fueled the long-term increase in carcass weights.