Carcass quality spreads widen on seasonal demand

MARKET UPDATE

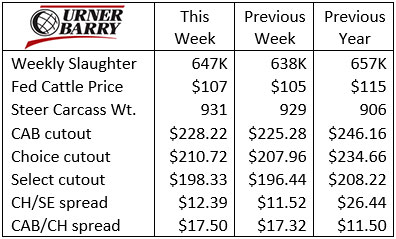

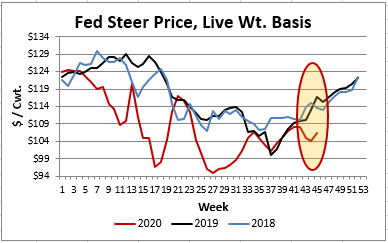

In the last CAB Insider, we reported on a rapidly retreating fed cattle market scenario. However, much has changed in the two-week interim. Last week’s $1 to $2/cwt. advance is just a fraction of what many believe this November market is capable of.

Optimism early this week on news of a potential COVID-19 vaccine spilled over from the equity market, splashing big positive moves across commodity futures. Live Cattle contracts were a benefactor, with the nearby December contract nearing $112/cwt. Monday and Tuesday.

This week’s spot fed-cattle market is poised to see higher values again, with three factors driving the change. First, the negative basis will have cattle feeders standing their ground on price, potentially holding cattle. Second, carcass cutout values were higher last week, with even more optimism Monday and Tuesday. Finally, feedyard show lists are trending seasonally lower, appropriate for November, but likely a more dramatically lower shift than many suspected.

Packer margins are widening again and cutout values are moving upward more rapidly than their cattle input costs. They’ll be more likely to acquiesce to higher asking prices and have little basis for argument amidst more optimistic market indicators.

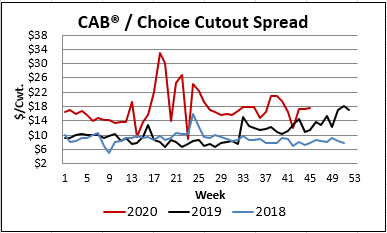

We’re seeing very good demand in the boxed beef market, with last week beginning a firm foundation. The CAB cutout value was nearly $3/cwt. higher on the week. Choice was up by $2.75/cwt. while Select lagged behind with just a $1.89/cwt. increase.

Holiday rib business is driving the price complex to meet expectations. The heavy CAB ribeye price has run higher than a year ago since August 1st by an average of 3.7%.

Carcass quality spreads widen on seasonal demand

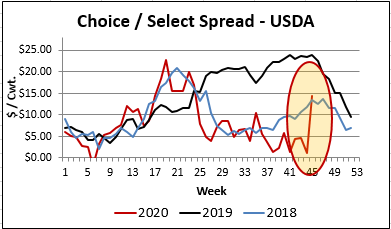

From a feedyard’s perspective, the fourth-quarter quality spreads are an important seasonal factor. Many feeders with high-quality Angus genetics in their inventory procure cattle with the expectation that carcass quality premiums will be near their annual highs during this period.

The current Choice/Select spread near $13/cwt. is roughly half as large as it was a year ago at this time. While this seems like a weaker demand signal, we need to take a look at the supply side to get a clear picture.

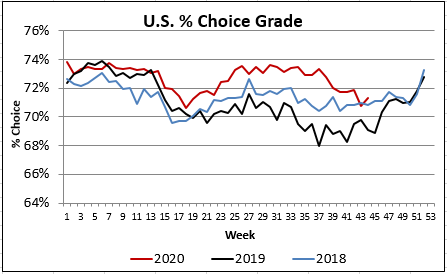

The 2019 quality grade trend underperformed 2018 trends beginning as early as May, only to worsen into the fall. In contrast, the 2020 Choice grade has run higher than anticipated due to longer days on feed for many cattle through the backlog.

Furthermore, the Tyson packing plant fire a year ago in August had a lingering effect on boxed beef prices, elevating values through last fall.

The 2020 CAB carcass premium above Choice stands in contrast to the trends noted above. We’ve seen a larger percentage of carcasses qualifying for the brand this year, in keeping with the higher Choice grading trend. Still, the CAB cutout premium above Choice, while quite variable, has averaged $7.43/cwt. higher than a year ago.

Factors on the right track

The October setbacks to Live Cattle futures contracts stymied much-needed fourth-quarter price momentum from the cattle feeder’s perspective. Fear of the unknown regarding rising COVID-19 cases became a factor, with potential impacts to both supply and demand, among other things.

Normally, the fourth quarter brings on higher beef cutout and fed cattle values like clockwork each year. It appears that we’re on this track again in November, but we’re beginning the race well behind the starting line, thanks to October’s disappointments.

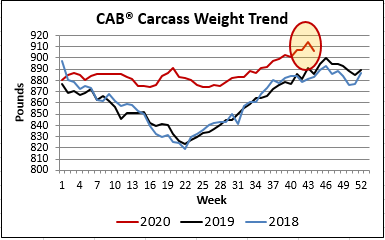

However, there are some positive fundamental indicators in the market at this time. CAB carcass weights in the latest data from October 26th were lower by 8 lb. This data is one week ahead of the confirmed USDA weights report, so we’re awaiting more information across the entire fed-cattle sector.

Winter weather has hit the northern feeding region this week, likely slowing feedlot gains and pulling carcass weights lower in the short term.

If the fall peak in carcass weights at the beginning of November is real, this would suggest an earlier end to the increasing fall-weight trend than we saw in the past two years. This would have an encouraging effect on cattle prices, as total production tonnage wouldn’t be burdened further by record carcass weights.

Also encouraging to the price complex is that beef quality spreads are increasing sharply, even with quality grading simultaneously on the uptick. Back to basic economics, higher prices in the presence of greater supplies spells increased demand.

DON’T MISS THE LATEST HEADLINES!

Leadership amid change

Register for free CAB webinar

The III big things

Read More CAB Insider

Credit End Meats With CAB Value-Add

We focused on fourth-quarter middle meat demand as a beef price driver in the last edition of the Insider. This is certainly the case in the current data as rib and tenderloins are pricing near their annual highs. However, a look at annual price trends across the beef carcass shows increasing contributions to CAB premiums from both ends of the carcass.

Middle Meats and Supply Driving Fourth Quarter Spreads

At the retail level, November brings a brief shift in focus, away from beef to turkey and ham, for Thanksgiving meals. Turkeys are the classic “loss leader” item in grocery stores during November as retailers practically give them away to lure a volume of shoppers to spend on the high-margin center of the store goods.

CAB Brand Sales Third Best in 45-Year History

In this CAB Insider,shifting market dynamics have already marked trend changes in the 2023 cattle and beef markets. These shifts are most succinctly summarized through two factors, fewer cattle and higher prices, that will further entrench themselves in near term trends.